In Canada, you need a good credit score to buy a house. The reason is that most mortgage lenders, such as major banks, use your credit score to determine if you are a risk on defaulting on your home loan.

The higher your credit score, the better your mortgage terms are likely to be, which usually comes in the form of lower interest rates. If you have a bad credit score, lenders will see you as more of a risk—meaning higher interest rates throughout the life of the loan.

But it is not always so simple. What qualifies as a good credit score in Canada? How does your credit score impact your mortgage? And how do you improve your credit score?

Here is everything you need to know about credit scores to buy a house in Canada.

To our audience of mortgage professionals, this article can serve as a valuable tool for any of your clients who are asking about calculating home equity. Send this along to them in an e-mail after helping them.

What is the best credit score to buy a house?

In Canada, the best credit score to buy a house is anything above 660. This type of credit score indicates to mortgage lenders that you are at a low risk to default on your mortgage, and you are a safer candidate for a home loan. While 660 may be considered solid, credit scores can range from around 300, which is considered poor, to 900, which is considered excellent.

Essentially, the higher your credit score, the better your chances are of qualifying for a mortgage. Having a strong credit score will make sure that you:

- Are approved for the mortgage

- Secure a favourable interest rate

For most traditional mortgages in Canada, the minimum credit score you need to get approval for a traditional mortgage is roughly 680, although the minimum requirement can differ depending on the type of mortgage you are looking for and the lender. While some mortgage lenders could potentially go lower, the higher the better. When applying for a mortgage, a credit score that is higher than 700 would be optimal.

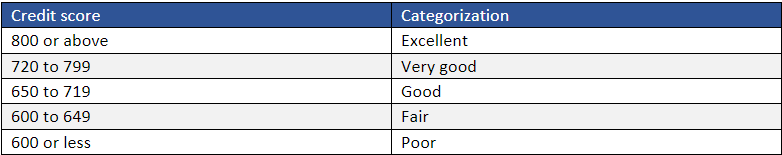

Here is a breakdown of each credit score and how most lenders view them:

Factors that impact credit score

There are numerous factors that can affect your credit score. These may include:

- Credit history. Credit history is a record of how you handle money and debt, including credit card accounts and other loans. The longer your credit history, i.e., credit accounts, the better it will be when you apply for a home loan.

- Credit utilization. Credit utilization is the percentage of your total credit you are using compared to how much available credit you have. Typically, you should use less than 35% of your available credit.

- New credit requests. To ensure a healthy credit score, it is important to refrain from applying for too many loans or credit cards, especially recently.

- Payment history. Payment history is a record of your previous debt payments. Again, to maintain a solid credit score, you will want to make sure that you pay credit card bills, for instance, on time.

- Types of credit. Having a mix of different types of credit will be best for you, such as having a line of credit and a credit card.

How to check your credit score in Canada

If you want to check your credit score in Canada, you request it from one of the two credit-reporting agencies in the country: TransUnion or Equifax Canada. You can either look it up any time you want for a fee or you can request a free copy of your credit score every year, which is an especially good idea for first-time home buyers.

How your credit score impacts your mortgage

Your credit score can have a negative or a positive effect on both your ability to qualify for your mortgage and the terms you are offered. The reason is that your credit score determines how at risk you are for defaulting on your home loan.

You will have a higher credit score and be seen as a low risk if your credit score shows that you do not have a lot of debt and you make regular payments. You will have a lower credit score, and therefore be seen as a high risk by lenders, if you have a lot of debt and are late on paying your bills.

Lenders such as banks do not want to lend a lot of money to a borrower that they deem to be unlikely to repay the loan. If, based on your credit score, a lender does deem you a risk of defaulting, you will have to pay a much higher interest rate throughout the life of the loan to reflect that level of risk. If you pay higher interest rates, you mortgage payments will be significantly more expensive and it will cost you a lot more money in the long term.

Can you get a mortgage in Canada with bad credit?

Yes. Conventional mortgages in Canada typically come with a 20% downpayment requirement and do not require Canada Mortgage and Housing Corporation (CMHC) insurance. This means that there are less restrictions on factors such as minimum credit score requirements and the guidelines are determined by each lender. There are also first-time home buyer programs offered in Canada that may help you.

In other words, it is possible to get approved for a mortgage with a credit score as low as 600. However, the number of lenders who are willing to approve your home loan will be narrow the lower your score.

Options to get a mortgage with bad credit

If you have bad credit and have difficulty securing a mortgage from a bigger mortgage lender like a major bank, you can look to trust companies and credit unions or subprime and private lenders. If you are deemed a risky borrower otherwise, these kinds of financial institutions are often more likely to help you. In either case, however, if you apply for a home loan with a bad credit score, you will be much more likely to pay a significantly higher interest rate.

If you have a limited credit history or a bad credit score, your other options may include:

- Adding a co-signer

- Considering a joint mortgage

- Saving more money so that you can make a larger down payment

How can I improve my credit score?

If you manage your credit responsibly, you will increase your credit score. How can you manage your credit more responsibly? Here are three tips:

- Establish credit history

- Pay your bills on time

- Limit new credit requests

Let’s take a closer look at each of these tips for improving your credit score so that you will be in a better position when you do apply for that mortgage:

1. Establish credit history

You can establish your credit history by getting a credit card and using it for things that you would purchase anyway, such as groceries. If you are unsure what it is, you can access and see your credit history by getting a credit report through a credit bureau. You can request a free credit report every year from TransUnion and Equifax and it will not affect your credit score. You can make the request either online or through phone or email.

2. Pay your bills on time

To maintain a strong repayment history and to improve your credit score, you should try to pay your bills on time and in fully. If you are unable to pay the bill in full, it is important to at least try to meet the minimum payment. If you think you will have difficulty paying your bill, you can always contact your lender.

3. Limit new credit requests

It is important to limit any new credit requests such as applying for credit or switching credit cards too frequently. Do not let small balances add up and try to keep your total debt in check.

One good tip from TD Bank is to try to get the most out of your credit card. In other words, make regular payments on time. If you have difficulty staying on track with your credit card payments, you can always set up pre-authorized payments from your bank account.

How can I maintain my credit score?

One key way to maintain your credit score is to ensure your debt-to-credit ratio remains at 35%, which you can do by adding up all your credit limits and multiplying the total by 35%. When using credit or borrowing money, that is the amount you should ideally try to avoid.

But there are other tips for maintaining a strong credit score to secure that mortgage loan, including:

- Too much credit

- Exceeding credit limit

1. Too much credit

You should avoid applying for too much credit, such as having too many credit cards, for instance—which comes with a downside. For one, you might be tempted to use them and spend more money in the process. This also means you should avoid applying for too many loans, especially in a short time frame. This activity also negatively affects your credit score.

2. Exceeding credit limit

You should also avoid exceeding your credit limit. Your credit score will also drop as a result.

While there are other factors that indicate to lenders whether you are likely to repay your loan on time, credit scores are at the top of the list. Remember: the definition of a good credit score varies depending on the mortgage lender, but you generally want to be between around 680 when applying for a mortgage. It is important to know your credit history for the mortgage type that best fits your financial needs.

Before committing yourself to getting your mortgage, do your research, such as checking in on what the best mortgage lenders in your area can do for you.

Have experience with working on your credit score to buy a house? Let us know in the comment section below what you did to reach your goal.